The Bank of Canada (BOC) and the European Central Bank (ECB) cut interest rates in early June as predicted in our Q1 commentary

Our expectation that this will be the first of many, and the dovish tone of the accompanying communications, suggests that another rate cut in July may be in the cards. For now, our forecast is that there will be three more 25 bp cuts this year, implying that the BOC will pause at one of its meetings, but if anything, the odds seem to favour cuts at every meeting.

The decision to cut the policy rate by 25 bps seemed to follow the weaker-than-expected first-quarter GDP data. The BOC statement shrugged off the solid 3.0% annualized rise in consumption and simply noted that overall gross domestic product (GDP) growth was slower than expected, consistent with the idea that excess capacity continues to accrue.

The most striking thing about the statement is what it did not say, which was any reference to taking a cautious or gradual approach to policy loosening, instead simply noting that "risks to the inflation outlook remain." In his opening statement at the accompanying press conference, Governor Tiff Macklem notes that "it is reasonable to expect further cuts to our policy interest rate," even if the Bank is "taking our interest rate decisions one meeting at a time."

"May's surprisingly large jump in euro-zone services inflation may have been due to the most unlikely of culprits: Taylor Swift."

On the Euro front, we received some good news on inflation. May's surprisingly large jump in euro-zone services inflation may have been due to the most unlikely of culprits: Taylor Swift. So, to some extent, the ECB can "shake it off" (apologies - I couldn't help myself), but yes, you read that correctly. Inflation rose quite sharply in May, particularly in Spain and Portugal where Ms. Swift performed on her Eras Tour. Note that we saw a similar effect last year in Sweden at the time of a Beyoncé concert.

There has been some speculation that the European soccer championship (being held in Germany during June and July) and the Summer Olympics in Paris might push services inflation up further. However, looking beyond these temporary blips, we think that the ECB will continue with a gradual pace of interest rate cuts.

"In response to the soft May CPI, PPI and import price data, the markets share our view that the Fed will most likely cut twice this year - in both September and December."

Shifting focus to the U.S., the Federal Reserve's (the Fed) updated projections indicated that a slim majority of officials favour fewer than two interest rate cuts this year. In response to the soft May CPI, PPI and import price data, the markets share our view that the Fed will most likely cut twice this year - in both September and December.

Although there is a lot of focus and hoopla on the timing of rate cuts, we think what is more important for markets is how deep those cuts ultimately are, rather than the exact timing of rate cuts. In other words, we suspect investors should focus on the depth of cuts relative to what's priced in, as opposed to their start date. As we noted in previous commentaries, our expectations are that central banks in most developed markets will cut more than what is currently priced in by the end of 2025.

Roaring Kitty Returns and Spurs Renewed Concerns of a Bubble

Investors might remember Keith Gill, better known as "Roaring Kitty", the social influencer who inspired the 2021 meme stock frenzy in companies such as GameStop and AMC. Well, after a years-long absence, he is back, inspiring the latest buying mania in GameStop. Even if interest in meme stocks rebounds following the renewed surge in GameStop's share price, some of the telltale signs that a bubble in the broader stock market may be entering its final stages, such as excessive leverage, are absent. This suggests to us that the current one remains a long way off from bursting.

A few years ago, we weighed the evidence for a bubble in the stock market during the meme stock craze. As a reminder, that episode featured an army of bored retail investors, influenced by social media conversations, ploughing money that they had received from government stimulus cheques during the pandemic into heavily shorted equities such as GameStop and AMC.

At that time, we noted that bubbles in stock markets were typically accompanied by high and rising leverage, whereas the meme stock mania was mainly about channelling money from stimulus cheques. High and rising leverage was a feature of the 1929 Great Crash, the bursting of the dot com bubble and the Global Financial Crisis (GFC). Leverage levels in 2021 weren't excessive, at least relative to the size of the broad stock market, hence, we weren't convinced then that the market was in a bubble that would soon burst.

"...the bubble that appears to be inflating now amid the hype around Artificial Intelligence doesn't appear to us to be clearly being inflated by leverage."

Today, the amount of leverage (margin debt), doesn't seem to be a concerning feature. It hasn't risen in recent years by as much as the stock market and declined relative to the capitalization of equity markets. While there may be increased leverage taking place today that is hard to spot (for example option trading among retail investors or within hedge funds), the bubble that appears to be inflating now amid the hype around Artificial Intelligence doesn't appear to us to be clearly being inflated by leverage.

Excessive risk-taking at banks can be another sign of a systemic bubble in the stock market that is entering its final stages. However, leverage at U.S. banks has declined since the GFC, something that probably helped contain last year's mini-banking crisis (remember Silicon Valley Bank, First Republic Bank, etc.).

For a more amusing and fuller account of bubbles and what to look for, I would recommend subscribing to Acadian's Owenomics blog, where senior portfolio manager and researcher Owen Lamont shares his views on market events and investor behaviour through an academic and practitioner lens: Owenomics: Observations on Behavioral Finance & Markets

Economic Outperformance does not Equal Market Outperformance

One feature of markets and investor behaviour is that investors tend to latch onto historical narratives, believing that past trends will continue indefinitely into the future. In my career, this was evident through the 90's when Canadian equities greatly underperformed U.S. equities due to the dot-com bubble. After the bubble burst, Canadian equities were in vogue again for nearly a decade.

Canada's outperformance during that time was due to a variety of factors, including acceleration from Chinese growth which caused commodity and agricultural prices to rise, coupled with increased debt by Canadian households which lifted our banks and last but not least, America's troubles during that time - 9/11, two recessions and government deadlocks. But as they say, all good things do come to an end.

"In my conversations with investors, I see the same mistakes happening today: with the belief that U.S. equities can do no wrong."

In my conversations with investors, I see the same mistakes happening today: with the belief that U.S. equities can do no wrong. A persistent feature of the post-pandemic age has been the relative strength of the U.S. economy and equities market. But past performance is no guarantee of future results. Will the U.S. continue to dominate the world economy, and its markets to outperform global benchmarks? Yes and no.

Over the past two years, U.S. GDP has grown by 4.8%, compared to just 0.90% in the euro-zone, 1.63% in Canada and 0.41% growth in the UK. The return on U.S. equities in that time has been 1.6 times higher than the return on the MSCI ex-US World Equity Index.

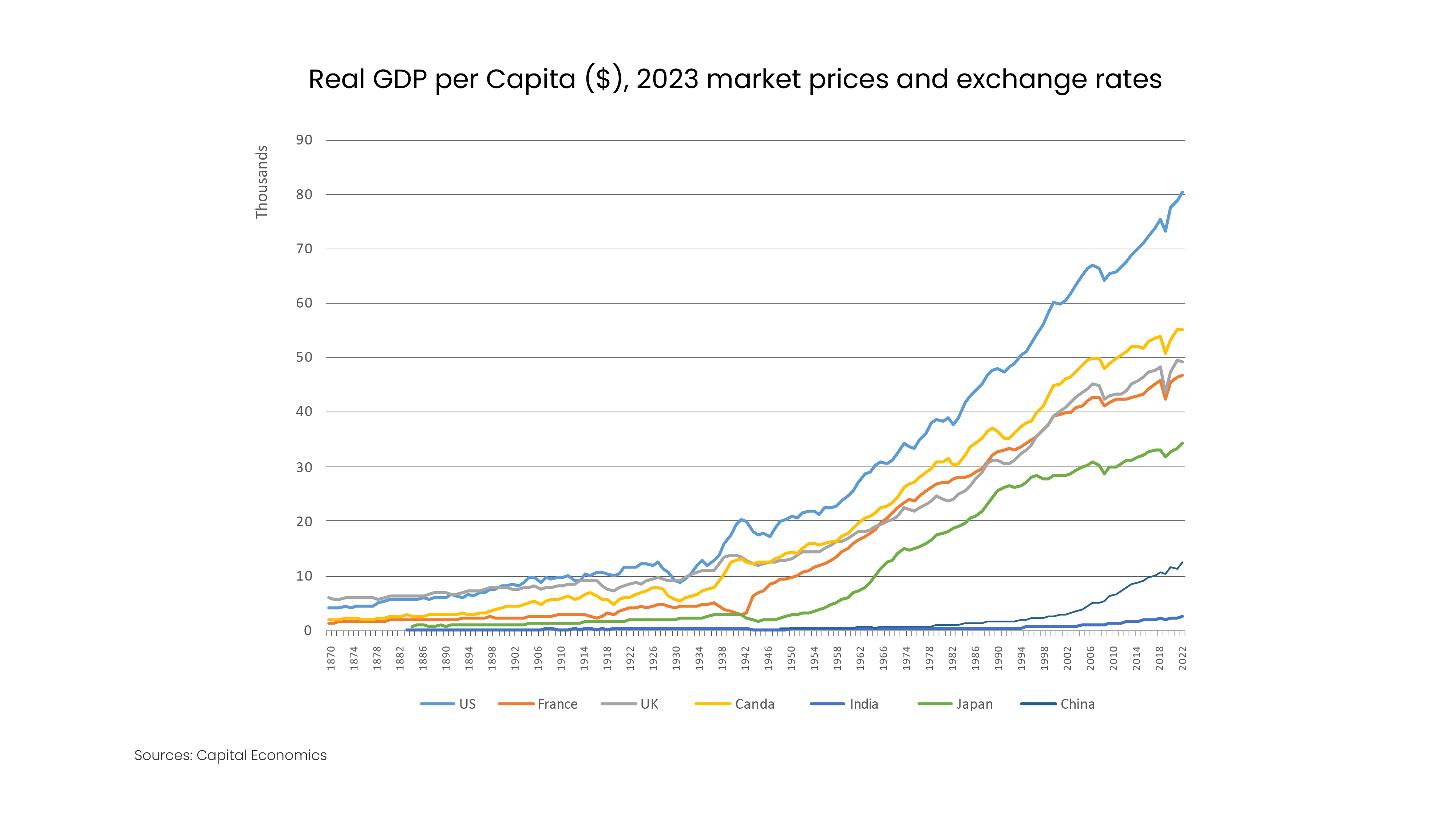

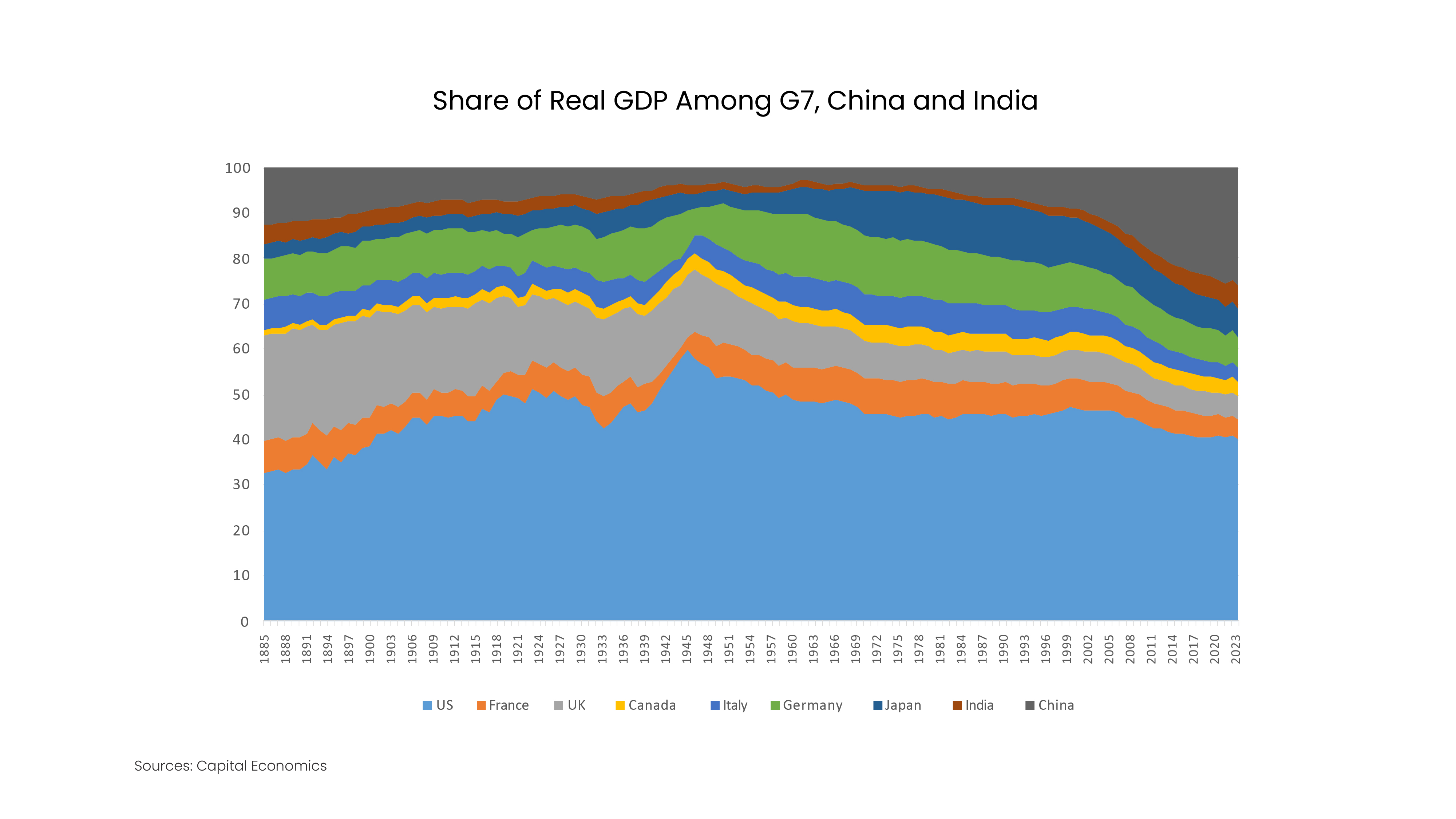

This is about more than just a temporary period of economic outperformance. The American economy, which has been the world's largest since the 1870s, has been doing better than its developed market peers for decades, with real GDP growth averaging 2.25% a year since 1990 compared with 1.7% in the UK, 1.4% in France and 0.7% in Japan. In that time, major emerging markets such as China and India have grown faster, but this has been so-called "catch-up" growth from what are still relatively low levels of income. Measured at current exchange rates, China's GDP per capita is still only 30% that of the U.S., while India's is just 10%.

American economic dominance extends beyond more than just the pace at which its GDP has been increasing. The U.S. dominates the rest of the world in economic, financial, and technological terms. Yes, it faces challenges in some areas. China's economy is now close in size to that of the U.S., while Singapore and Switzerland rival the U.S. on measures of innovation and technological leadership. But the U.S. is the only economy that ranks in the world's top five on measures of GDP, financial market depth and technological innovation.

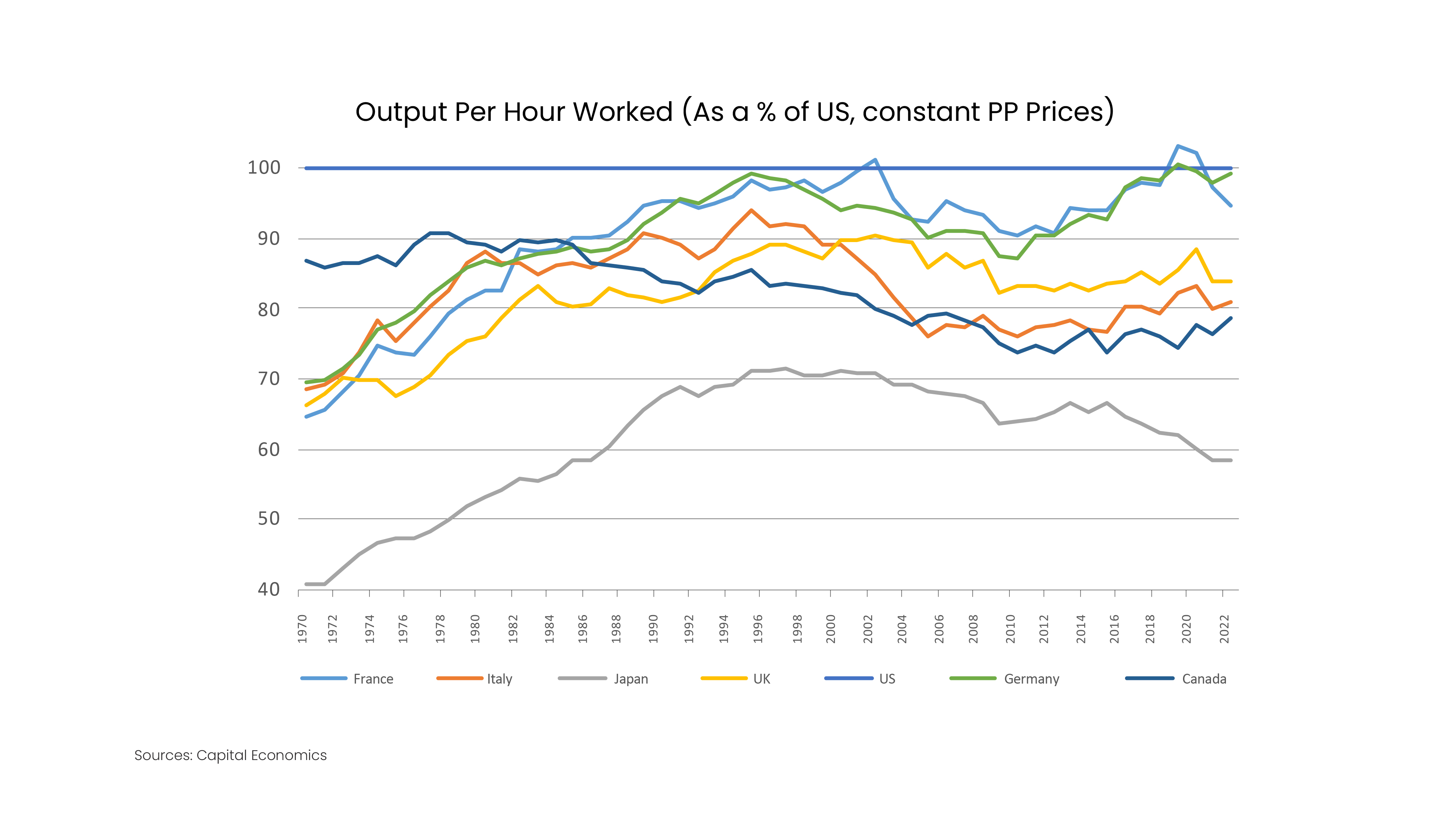

America's strength is partly a function of its relatively large population, the world's third largest. But real global dominance requires high levels of productivity alongside a sizeable population. As the Nobel Prize- winning economist Paul Krugman famously said, "Productivity isn't everything, but in the long run it's almost everything". America has been consistently more productive than its economic rivals for a long time. A variety of factors work in favour of the Americans on this front, including deep capital markets, an ability to attract skilled migrants, high research and development spending and an entrepreneurial culture.

Stock market buoyancy, the other feature of American outperformance since the pandemic, may prove less resilient. Earnings per share and valuations have risen sharply on the back of a strong economy, while equities have also been lifted by optimism around artificial intelligence (AI) - particularly large tech firms.

"We suspect this optimism will continue to propel the U.S. market over the next 18 months, but enthusiasm around AI has all the hallmarks of an inflating bubble."

We suspect this optimism will continue to propel the U.S. market over the next 18 months, but enthusiasm around AI has all the hallmarks of an inflating bubble. Once it bursts, as it inevitably will, the U.S. stock market will be destined for a period of significant underperformance relative to its peers.

This raises the question of whether a bursting equities bubble in itself threatens America's global economic position. It didn't in 1929, nor in 2001. The drivers of U.S. dominance are too fundamental to be challenged by the occasional bout of irrational exuberance.

What Do Market Conditions Mean for Your Portfolios?

We are maintaining our overweight position in equities that we enacted early in the second quarter. We continue to favour U.S. large-cap equities over International and Canadian. Having said this, we still foresee GDP growth slowing in developed economies. Our positioning is based primarily on our expectation that the emerging bubble centered around artificial intelligence stocks has a lot further to run. Central banks easing policy would certainly help at the margin as many past bubbles are associated with relatively loose monetary policy. Despite our overweight positioning in U.S. large-cap equities, we see long-term opportunities in areas of financial markets where investors are in distress and/or sentiment is exceedingly poor.

Commercial real estate comes to mind. Although a lot of bad news now appears to be priced into commercial real estate investment trusts (REITs), the sector still faces significant challenges. This suggests to us that a material improvement in its fortunes is not likely soon. Having said that, relative valuation is looking increasingly attractive. At the end of May, the spread between the dividend yield of the index and the earnings yield of the S&P 500 had risen to its highest level since the dot-com bubble. Such a comparison is useful in our view since REITs are required to distribute at least 90% of their income. That may bode well for its relative performance in the long run at least. For now, we remain underweight, but I expect that sometime in the next 18 months we will look to increase our position size.

Sincerely,

Corrado Tiralongo

Chief Investment Officer

IPC Portfolio Services